What is SLOC Funding and How Does It Work?

SLOC funding, or a Secured Line of Credit, offers a flexible borrowing solution for product development. It provides the ability to access funds for 12-15 months. This allows you to spread out your expenses over time, making it easier to budget for critical phases like design, prototyping, and manufacturing. SLOC funding works like a credit line, meaning you can borrow what you need and only pay interest on the amount used. Unlike traditional loans, you have control over how much and when you borrow. This funding option is suitable for both personal and business use, offering versatility depending on your unique financial needs.

Our Partnership with TORO Funding: Making SLOC Loans Accessible

Partnering with the right funding provider makes all the difference. TORO Funding simplifies the process of securing SLOC loans. They specialize in helping inventors and entrepreneurs access the money they need to move forward quickly. Their streamlined application process and transparent terms help eliminate unnecessary stress. By working with TORO, you gain access to a reliable funding partner who understands the importance of acting fast in today’s competitive market. This partnership makes it easier than ever to secure funding for your project without unnecessary roadblocks or delays.

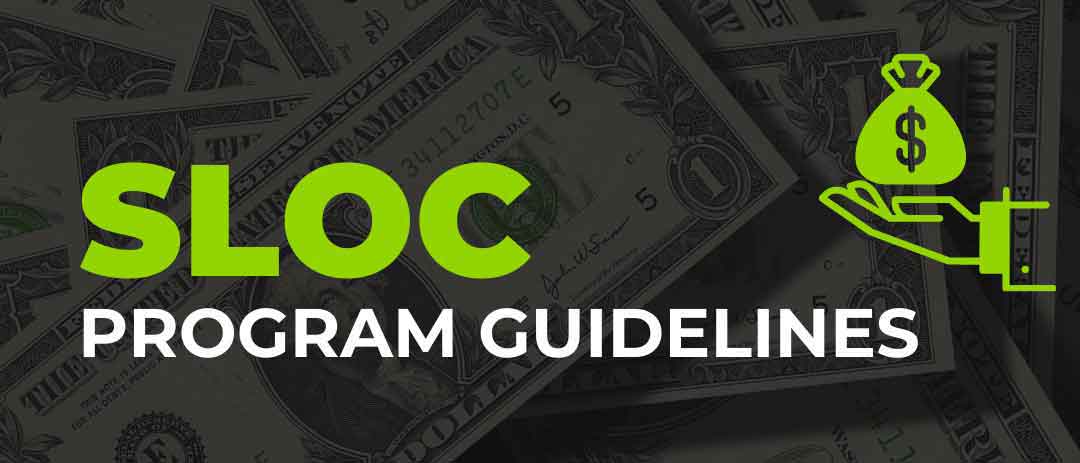

Our SLOC Program Guidelines

- Credit Score of 680+

- Funding Range: 1K-100K; Avg. 50K

- No outstanding Charge-Offs

- Great Payment History

- At Least A Year of Individual Credit History

- Hard Inquires: 4 or Less in the Last 6 Months

- No Time in Business Required

- No revenue Requirements

- No Restricted Industries – WE FUND IT ALL

- Co-borrowers Accepted

- Term Loan Options Available

Why SLOC Funding is Ideal for Product Development

Product development often comes with significant upfront costs. From concept design to full-scale manufacturing, these costs can strain your budget. SLOC funding solves this issue by allowing you to borrow money incrementally. You can pay for crucial steps like prototyping or material acquisition without draining your personal savings. The flexibility of a line of credit also ensures you only use funds when necessary. This targeted use of resources keeps your project on track without unnecessary overspending. With SLOC funding, you gain the financial breathing room to focus on developing a high-quality product.

The Benefits of SLOC Funding for Startups and Inventors

Startups and inventors face unique challenges in securing funding. Traditional loans often have strict requirements, making them difficult to obtain. SLOC funding offers a solution tailored to your needs. First, it’s more accessible for those with limited financial history. Second, it provides flexibility in repayment, ensuring you can align payments with your project’s timeline. Additionally, SLOC funding allows you to adapt quickly. If unexpected expenses arise, you have immediate access to funds. This agility can make the difference between meeting deadlines and facing costly delays. Overall, it’s a powerful tool for turning ideas into reality.

How SLOC Funding Helps You Stay Ahead of Competitors

In today’s fast-paced market, speed matters. Delayed funding can cause missed opportunities and give competitors a significant advantage. SLOC funding ensures you stay competitive by providing quick access to the resources you need. While others scramble to secure traditional financing, you can push forward with prototyping, testing, and marketing. This speed-to-market advantage often translates to greater market share and stronger brand recognition. Additionally, having financial flexibility allows you to explore innovations your competitors might overlook. By leveraging SLOC funding, you can keep your product development process moving efficiently.

Using SLOC Loans for Design, Prototyping, and Manufacturing

The product development journey involves multiple stages, each requiring careful financial planning. SLOC loans are ideal for covering expenses at every step. During the design phase, funds can be used to hire professional designers or purchase necessary software. Prototyping often requires specialized materials or equipment, which can be costly. SLOC funding ensures you have the resources to create a functional prototype without compromising quality. Manufacturing, whether small-scale or large-scale, comes with high upfront costs. With SLOC funding, you can secure materials, hire skilled labor, and meet production deadlines without financial stress.

Personal vs. Business SLOC Loans: What’s the Difference?

SLOC loans are available for both personal and business use, offering options depending on your circumstances. Personal SLOC loans are ideal for individuals who want to fund smaller projects or avoid mixing business finances with personal ones. These loans are easier to qualify for and typically involve fewer requirements. Business SLOC loans, on the other hand, are suited for larger-scale operations. They allow businesses to access higher credit limits and align funding with operational needs. Understanding these differences ensures you choose the right loan type for your specific project requirements.

Common Challenges in Product Development and How SLOC Funding Solves Them

Product development often comes with financial hurdles. One common issue is running out of funds before completing critical phases. SLOC funding addresses this by providing a financial cushion. Another challenge is balancing cash flow while managing long-term investments. A line of credit ensures you can cover short-term needs without derailing your overall budget. Additionally, many entrepreneurs face difficulties in securing financing fast enough. The streamlined application process for SLOC loans ensures you get funding when you need it most. These features make SLOC funding an effective solution for overcoming common development challenges.

The Fast-Track to Funding: How to Apply for a SLOC Loan

Applying for a SLOC loan is a straightforward process designed to save time. Start by assessing your financial needs and determining how much funding is required. Gather any necessary documentation, such as proof of income or business financial records. Partnering with TORO Funding simplifies this process further. Their team helps guide you through every step, ensuring you meet all requirements. Once approved, you gain immediate access to your credit line. This fast approval process ensures your project stays on schedule, allowing you to focus on development rather than funding delays.

Why Lime Design is Your Partner in Funding and Product Development Success

Choosing the right partner can make or break your product development journey. By leveraging SLOC funding, you gain financial flexibility that ensures your project’s success. The partnership with TORO Funding eliminates many traditional barriers to financing. This collaboration ensures you’re supported every step of the way, from securing funding to completing your product. With access to expert guidance and reliable resources, you can focus on innovation and execution. SLOC funding provides the financial tools you need to bring your vision to life, ensuring you achieve your goals efficiently.

Lime Design's Approach to Perfecting Product Development

In the realm of product development, there is an art to embracing failure as a catalyst for growth and improvement. Lime Design, a leading product development firm, has mastered the art of failing forward, using it as a powerful tool to uncover and refine imperfections in the journey of bringing an inventor’s idea to life. By understanding the value of iteration and actively seeking out failures, Lime Design’s team is able to transform setbacks into stepping stones towards creating exceptional products. In this blog, we delve into Lime Design’s unique approach and how they harness the art of failing forward to perfect the development process.

Bring your product idea to life! Avoid the common pitfalls of designing and manufacturing alone. Let our team help you every step of the way. Contact us now and let’s build something great together!